No header bidding setup should be without floor price optimization

So in the previous article, we have illustrated that assuming that header-bidding setups solve all liquidity issues is an incorrect assumption.

Here then, are 2 more reasons why publishers using header bidding setups should continue to leverage floor price optimization to avoid “leaving money on the table”

REASON TWO: Even in Header Bidding setups, observed bid reduction is still high.

Just because there is a new technique to democratize demand (header bidding), doesn’t mean that there are suddenly more dollars and more buyers in the market – the demand ecosystem is largely unchanged – and header bidding partners bringing additional and unique demand are still rare. As such, the data tells us that bid reduction is still high, and liquidity is still low in most of the same areas it was before.

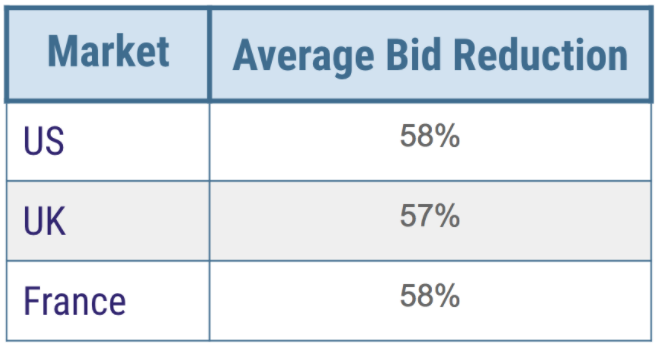

To evidence this point, we have assembled bid reduction data from publishers with at least 5 header partners for two full months (August and September 2017) to demonstrate the delta between value expressed by buyers (winning bid) and final clearing CPM (value captured by publishers). Here are the average bid reductions observed in the final auction referenced earlier, by geography:

Image Source: Adomik Analyze App

In a world where you can access more demand simultaneously, there’s still usually one buyer with a willingness to pay significantly more than others.

As you can see, even in this new world of democratized demand, there is still ample opportunity here to use a sound flooring strategy to capture more value for the publisher while keeping buyers happy.

(And by the way, we are just talking about environments where a second-price auction is still running — optimizing floors in a first-price world also makes sense!

REASON THREE: Modern setups render manual price floor setting counterproductive. Pricing needs to be dynamic to “match the market”.

Now that we understand the need for floor price optimization in a header setup, lets examine its frequency and scale.

The hot campaign yesterday is no longer in market today, new demand shows up unpredictably, the delta in the demand curves from December to January are stark, and new monetization partners are added/removed each week. Accordingly, each of the above changes shifts your yield equilibrium and requires pricing to be dynamic to adjust to these fluctuations. Each combination of supply and demand needs to have its unique optimal floor strategy that may work fine today, but not well tomorrow.

As a result, manual price optimization does not scale. Matching the market’s dynamics requires the use of computers and algorithms tuned specifically for this purpose. There are several reasons:

- Publishers aren’t equipped to search through all of their trading data from multiple demand sources to define the opportunities to raise and lower floors on a daily basis. This is a true “big data” problem involving petabytes of data each day.

- Publishers aren’t staffed to expend the time each day required to write 50-5,000 new rules per day to capture pricing opportunities across the many combinations of inventory and demand.

- Parallel setups (header bidding, dynamic competition between direct and programmatic) have created interrelations where local changes (e.g. an open auction floor update in the end auction) have holistic impacts (e.g. on the whole stack revenue). Factoring in those collateral impacts is cumbersome (to say the least).

The truth is, for publishers to maximize programmatic revenue in a header-bidding setup they need to automatically ‘match the market’ by setting optimal floors dynamically to adapt to market seasonality, changes in the stack, new partners, and holistic impacts.

If you are interested in learning how to use Adomik Price to automatically match the market with automated price optimization, head over to the site, check out our case studies, or reach out.

(Click here to see the previous article with the 1st reason to use floor price optimization in header bidding setups…)